The Ernst Consulting Statement of Cash Flows stands as a pivotal document, offering profound insights into a company’s financial health and performance. This comprehensive analysis delves into the intricate details of the statement of cash flows, exploring its significance, components, and implications for understanding a company’s financial strategy and stability.

Through a meticulous examination of operating, investing, and financing activities, this discourse unravels the sources and uses of cash, highlighting the interplay between net income and cash flow. It emphasizes the importance of analyzing trends and patterns, enabling readers to assess a company’s financial well-being and make informed decisions.

Ernst Consulting Statement of Cash Flows: Overview

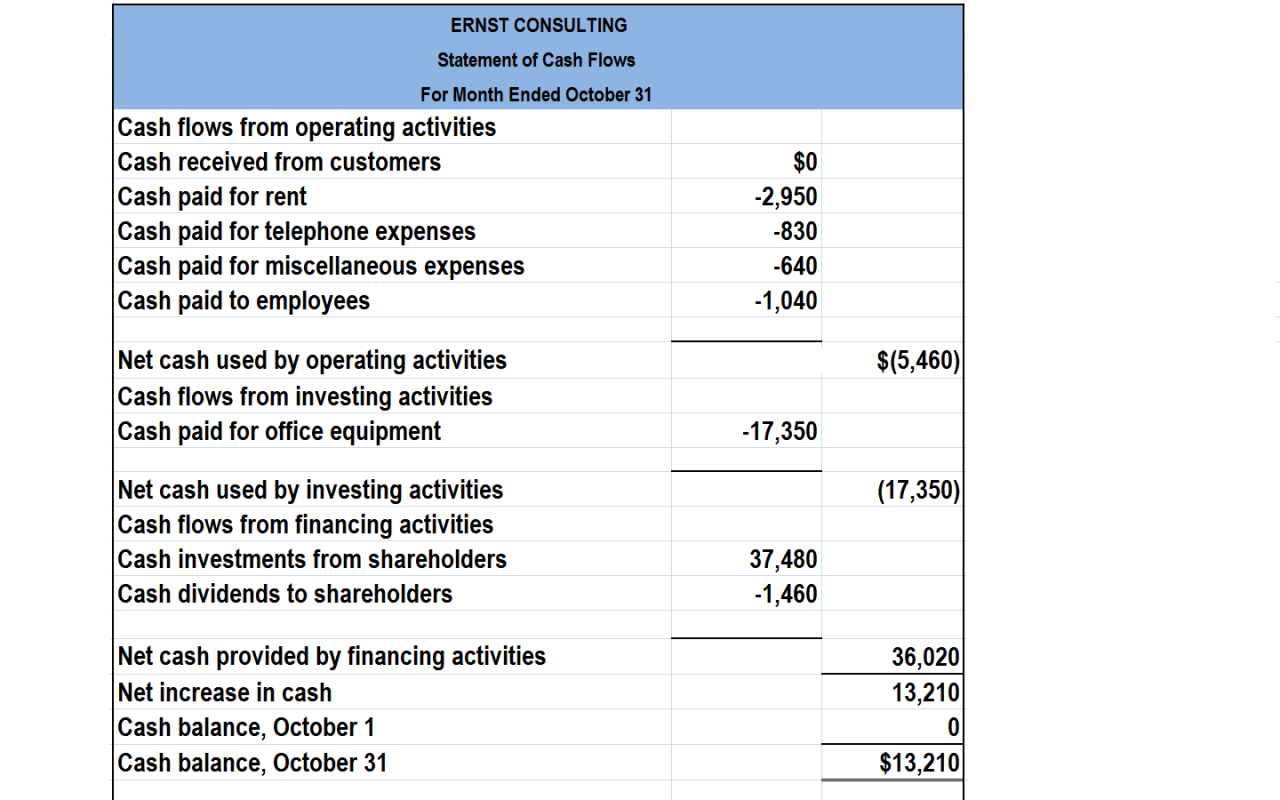

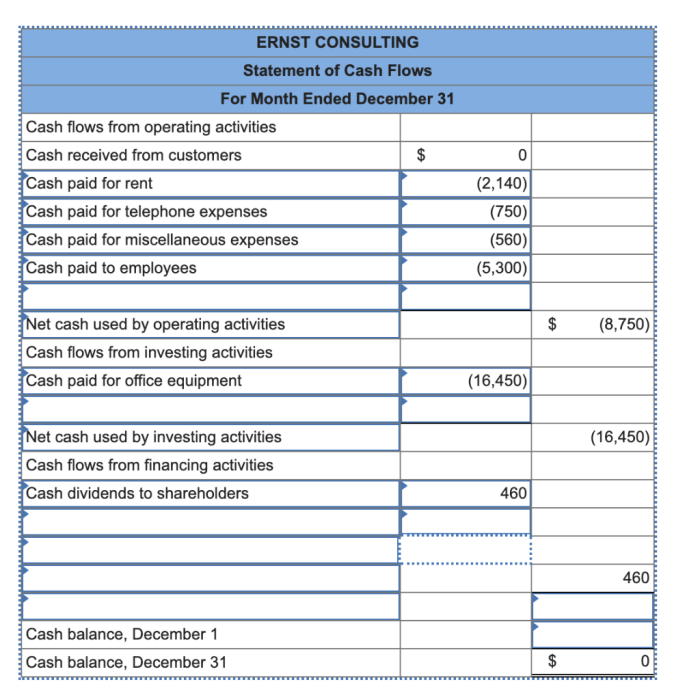

The statement of cash flows is a crucial financial statement that provides insights into the sources and uses of a company’s cash. It is divided into three main sections: operating activities, investing activities, and financing activities. The Ernst Consulting statement of cash flows is no exception, offering valuable information about the company’s cash flow performance.

The operating activities section captures the cash generated and used in the company’s primary business operations. The investing activities section reflects the company’s investments in assets such as property, equipment, and securities. Finally, the financing activities section shows how the company raises and uses funds through debt and equity financing.

Operating Activities

The operating activities section of the statement of cash flows provides information about the cash generated from the company’s core business operations. This section is crucial for understanding the company’s ability to generate cash from its ongoing operations.

The indirect method is commonly used to calculate cash flow from operating activities. This method starts with net income and adjusts it for non-cash items and changes in working capital. The resulting figure represents the cash generated or used in the company’s operating activities.

Reconciling net income to cash flow from operating activities is essential because it provides a clear picture of the company’s cash flow performance. This reconciliation helps identify the factors that have contributed to the difference between net income and cash flow from operating activities.

Investing Activities: Ernst Consulting Statement Of Cash Flows

The investing activities section of the statement of cash flows captures the cash used for acquiring or disposing of long-term assets. These activities include purchases or sales of property, equipment, and investments. Understanding cash flow from investing activities is crucial for assessing the company’s growth strategy and its ability to generate future cash flows.

There are various methods used to account for investments, including the cost method, equity method, and consolidation method. The choice of method depends on the level of control and ownership that the company has over the investment.

Financing Activities

The financing activities section of the statement of cash flows reflects the sources and uses of cash related to debt and equity financing. These activities include issuing or repaying debt, issuing or repurchasing shares, and paying dividends. Cash flow from financing activities provides insights into the company’s capital structure and its ability to raise funds.

Understanding the impact of debt and equity financing on cash flow is crucial. Debt financing involves borrowing money, which creates an obligation to repay the principal and interest. Equity financing, on the other hand, involves issuing shares, which does not create a repayment obligation but can dilute ownership.

Analysis and Interpretation

Analyzing trends and patterns in the statement of cash flows is essential for understanding a company’s financial health and performance. By comparing the statement of cash flows with other financial statements, such as the balance sheet and income statement, analysts can gain a comprehensive view of the company’s financial position.

The statement of cash flows can provide valuable insights into a company’s ability to generate cash from its operations, invest in growth, and manage its financial structure. By carefully analyzing the statement of cash flows, investors and analysts can make informed decisions about the company’s financial health and prospects.

Essential FAQs

What is the purpose of a statement of cash flows?

A statement of cash flows provides a detailed overview of the sources and uses of cash within a company, categorizing cash flows into operating, investing, and financing activities.

How is cash flow from operating activities calculated?

Cash flow from operating activities can be calculated using either the direct method or the indirect method. The indirect method adjusts net income for non-cash items and changes in working capital to arrive at cash flow from operations.

What is the significance of cash flow from investing activities?

Cash flow from investing activities reveals a company’s investment strategy and its impact on cash resources. It provides insights into the acquisition and disposal of long-term assets, such as property, plant, and equipment.